In September 2021, I invested Nat Eliason’s defi course. For those who don’t know, defi stands for decentralized finance. The course was $100 and my goal was to earn at least $100 in defi so the course was worth it.

I started trading on the Ethereum blockchain but stopped because of the outrageous gas fees. I then started experimenting with Polygon because the gas fees were more manageable. When Polygon’s gas fees got higher, I decided to switch to the Terra blockchain. Transactions on the Terra chain cost $.25 and they had, by far, the most comprehensive decentralized finance applications at the time.

While playing around on Terra, I learned about the Anchor Protocol. Anchor is an application where you could earn 20% APY on the dollar-pegged stablecoin TerraUSD (UST). When I first saw this I was like “Damn! 20%?! I’m making .05% in my savings account. Why not put all my savings in there?”

So, I set a reoccurring purchase for $500 worth of Luna every two weeks. It went a little something like this:

Buy Luna on crypto.com. Why Crypto.com and not some other popular exchange like Coinbase or Binance? Crypto.com allows you to bridge your tokens to other blockchains. For example, I could buy Luna on Crypto.com and send them directly to my wallet on the Terra blockchain. This was much easier and cheaper than buying on Coinbase, transferring to my Ethereum wallet, and then bridging to the Terra blockchain.

Convert LUNA to UST. Once I had my LUNA in my Terra wallet, I had to transfer it to UST. This part was easy. There is this app called Terra Station on the Terra blockchain that enables you to easily swap your LUNA for UST.

Send UST to Anchor Protocol. Once I had my UST, I’d send it to Anchor to earn 20% APY!

For 6 months I was earning 20% APY.

Until I wasn’t. Enter, the Fall of Terra.

At its peak, Terra was a $60B crypto ecosystem. But in May 2022, it all fell apart.

The algorithmic stablecoin UST depegged, plummeting to less than $.05. LUNA, which was meant to stabilize UST’s price, fell from $80 to a few cents. Your boy was down bad.

Here’s a chart showing the decline of UST.

And here’s a chart showing the decline of LUNA.

You might be wondering how this kind of thing happened. How could a $60B ecosystem vaporize into thin air? The answer?

Nobody really knows. There are a few theories, but I haven’t taken the time to really understand them so I’m not going to try and explain them. Anyways, this post is more about lessons learned from losing a bunch of money, rather than a post trying to figure out why I lost all that money. Maybe I’ll try and tackle that in a future piece, but for now, let’s dive into those lessons learned.

When something is too good to be true, it’s probably too good to be true

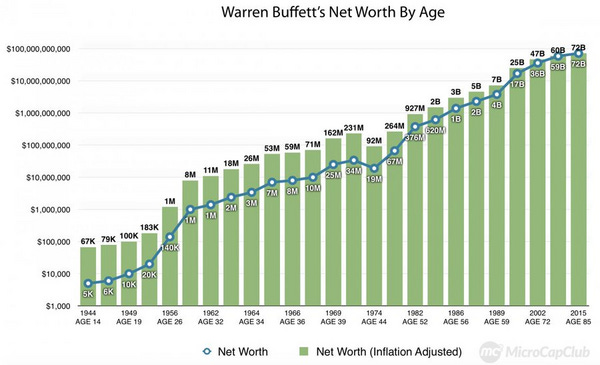

Get rich slowly: The most sustainable way to get rich is to get rich slowly. $81.5 billion of Warren Buffet’s $84.5 billion net worth came after he turned 65.

Understand your investments before making them: Crypto is really friggin confusing. It is undoubtedly the future, but man I sometimes can’t seem to wrap my head around this stuff. Here’s my new rule when deciding whether or not to invest in something: if you can’t explain your investment to a five-year-old, don’t invest in it.

Do your own research: I kind of FOMOed into Anchor. I saw that 20% APY and I was like “OOO I WANT IT!” I should’ve muted my monkey brain and conducted more research.

Avoid echo chambers: When I was doing my due diligence on Anchor, I only spoke with people who were invested in the platform: I followed Terra maxis on Twitter, joined Discord groups focused on Terra, listened to a bunch of Terra-based podcasts, and subscribed to a handful of YouTube channels focused on Terra. I should have been talking to people who weren’t invested in the platform, asking them their opinions on Terra. Instead, I got stuck in a big Anchor Protocol / Terra echo chamber where I only heard what I wanted to hear… “Go get that 20%!!!”

Check on incentives: Before investing in something, verify the incentives of each of the stakeholders. If I were smart, I would’ve dug a little deeper into Anchor Protocol and I would’ve realized that the 20% APY was essentially a user acquisition incentive; like every other liquidity pool with a high APY.

Don’t believe the hype: Is there’s a ton of hype around something, that should make you really skeptical about it. Don’t make any investment decisions without asking a bunch of questions and cutting through the hype.